Investing in America’s Clean Energy Future: the Inflation Reduction Act

Aug 16, 2022

by Amanda Cronin

Solar Tax Credit Increased to 30% and Extended for 10 Years

On August 12th, the House of Representatives passed the nation’s largest investment in climate action: the Inflation Reduction Act (IRA). This vote came five days after the Senate passed the IRA, and President Biden signed the bill into law on August 16th.

This historic piece of climate legislation has three main goals: (1) to decrease the amount of greenhouse gas emissions; (2) to decrease the impacts of climate change on the most affected and vulnerable populations; and (3) to establish the United States as a center of clean energy manufacturing and usage.

Investment Breakdown

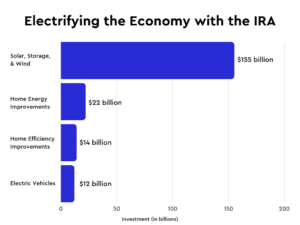

Among other policy measures, the bill calls for $369 billion to be invested in domestic energy security and climate change. Here is a closer look at the breakdown of funding:

The Inflation Reduction Act offers incentives that encourage consumers, businesses, and manufacturers to choose clean energy. What does this entail? Federal rebates, tax incentives, grants, and lending capacity to encourage the production and purchase of electric appliances, heat pumps, rooftop solar, home battery backup systems, efficiency retrofits, electric vehicles and EV charging, and a number of other home energy improvements that cut costs while boosting efficiency.

How To Benefit From the IRA

One of the most exciting provisions of the act is the extension of the federal tax credit. Since 2006, the solar investment tax credit (ITC) has allowed the U.S. solar industry to grow over 10,000%, creating more than 230,000 jobs while significantly lowering electricity costs for American families. Not only can the ITC be applied toward solar energy systems, but it also extends to solar plus battery storage systems.

Prior to the passage of the IRA, the ITC was expected to drop from 26% to 22% at the start of 2023 before disappearing completely in 2024. The IRA has increased the ITC to 30% for the next 10 years, allowing residents who install solar on their property to get 30% back on their federal taxes. This also applies to installations completed in 2022.

Additionally, the bill provides money saving incentives for drivers who switch to an electric vehicle. EVs that meet certain manufacturing requirements will be eligible for the full $7,500 rebate, while others will be eligible for half the rebate.

“This is a big moment for our entire country,” says EmPower’s CEO David G. Schieren. “We are increasing our energy resiliency, improving our economy, and enabling homeowners across the country to decrease their reliance on traditional energy sources.”

If you’re interested in lowering your electricity bills, now is the perfect time to go solar. Schedule a free consultation with our team of experts and see how much you can save with solar.

Stop overpaying for electric. Go solar with $0 down.

Stop overpaying for electric. Go solar with $0 down.

About the Author

EmPower Solar develops, engineers, installs, and services solar and battery systems for residential and commercial clients. Since 2003, EmPower Solar has empowered thousands of New York homeowners and businesses with 35 megawatts of distributed solar. Its vision is to create a new energy paradigm powered by clean, renewable energy for a more prosperous, healthy, and civil world. The company culture is defined by the EmPowering Way, which results in consistent 5-star customer service reviews. For more information visit empower-solar.com.